Healthcare & Alternative Lifestyles | The Financial Elephant in the Room

When we began researching tiny house living and alternative lifestyle options, we put together spreadsheets analyzing potential costs. We factored in the obvious expenses: the house itself, the lot rent, utilities, insurance, maintenance, and even factored in healthcare insurance.

But recent developments in our healthcare planning have inspired us to look more deeply into a challenge that extends far beyond our personal journey. It's a challenge that affects millions of Americans considering alternative lifestyles, early retirement, or self-employment paths.

The Healthcare Conundrum

The American healthcare system creates a significant barrier to lifestyle flexibility that few discuss openly. While our latest video shares our personal experience with this challenge, we wanted to use this space to explore the broader context.

Looking beyond our personal situation, let's explore the broader context of this issue...

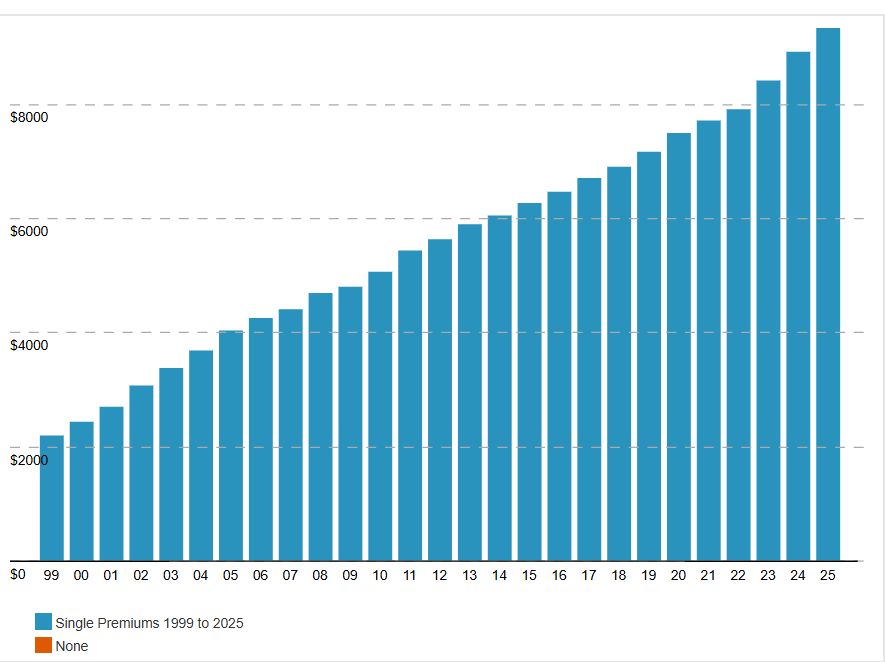

According to a 2025 Kaiser Family Foundation study, annual premiums for employer-sponsored family health coverage reached $26,993 this year, 6% higher than in 2024. On average, workers contributed $6,850 toward the cost of family coverage. Employers typically cover 75% of the premium.

When you leave traditional employment, that employer subsidy disappears.

Why This Matters Beyond Tiny Houses

This issue extends far beyond tiny house enthusiasts. It affects:

- Early retirement planners who may need to budget for additional expenses just for healthcare costs before Medicare eligibility

- Digital nomads who struggle with state-specific insurance plans while traveling

- Entrepreneurs and small business owners facing premium costs that can exceed their business profits in early years

- Creative professionals balancing freelance flexibility with healthcare security

- Homesteaders and off-grid enthusiasts seeking independence from systems while still needing medical care

The FIRE Movement's Healthcare Hurdle

The Financial Independence, Retire Early (FIRE) movement has brought significant attention to this issue. Many FIRE practitioners have discovered that their careful calculations for early retirement were upended by healthcare costs.

While someone might need $1 million to sustain a modest lifestyle in retirement, they might need another $500,000 to $1.5 million just to cover healthcare costs until Medicare eligibility at 65, depending on their early retirement age.

Creative Solutions We've Learned About

As we navigate this challenge ourselves, we're exploring various approaches that others in alternative lifestyles have implemented:

1. Health Share Ministries

These cost-sharing programs aren't insurance but provide a structure for sharing medical costs among members. They typically have lower monthly contributions but come with significant limitations and may exclude pre-existing conditions.

2. Part-Time Employment with Benefits

Some companies offer health benefits to employees working 20-30 hours weekly. This creates a middle path between full retirement and traditional employment.

3. Relocating to States with Better ACA Options

Healthcare costs and subsidy calculations vary significantly by location. Some states have more competitive marketplaces and better options for self-employed individuals.

4. Professional Associations and Guilds

Some professional organizations offer group health plans to members, potentially providing more affordable options than individual market rates.

5. Direct Primary Care + Catastrophic Coverage

This hybrid approach combines a membership-based primary care relationship with high-deductible catastrophic coverage for major medical events.

The Bigger Picture Question

Beyond individual solutions, this challenge raises fundamental questions about how our healthcare system influences life choices and freedom.

How many people remain in jobs they've outgrown primarily for health benefits? How many creative ventures, small businesses, or life reinventions never happen because of healthcare costs?

While we don't have all the answers, starting the conversation about this hidden barrier to alternative lifestyles feels essential. It's a system-level challenge that deserves more attention in discussions about financial freedom and life design.

Our Learning Journey Continues

We're still early in our research process, weighing options and considering creative solutions. As we learn more and test different approaches, we'll share our findings.

In the meantime, we're focusing on what we can control: continuing to build our tiny house life, making progress on projects that enhance our daily experience, and researching all available options.

Community Wisdom

If you've found creative solutions to the healthcare challenge while pursuing alternative lifestyles, we'd love to hear your experiences in the comments. What's working for you? What challenges have you faced?

This collective wisdom is invaluable as we all navigate systems that weren't designed for non-traditional life paths.

To see our personal healthcare shock and the latest on our tiny house progress, check out our latest YouTube video where we share the specific numbers we're facing and how they compare to our housing costs.

Want more behind-the-scenes reflections? Join our newsletter for exclusive content and conversations.

—Kathy & Bryan

Learning as we go

Member discussion